Difficulties and challenges in implementing Vietnam's rapid and sustainable development goals

(LLCT) - Vietnam has to deal with many difficulties and challenges during its rapid and sustainable development. The difficulties are due to weaknesses inside the economy such as: limited investment capital for development, low quality of human resources, low level of science and technology, low growth quality, backward export structure, low added value, depending on the FDI sector, shortcomings of the socialist-oriented market economy, etc. Challenges and obstacles are objectively originated from outside factors such as: deepening integration into the world economy, the lagging behind other countries in the world, the 4th industrial revolution, and global climate change.

Key words: rapid and sustainable development; economic growth.

Rapid and sustainable development is a consistent policy, delivering the political determination of the Communist Party of Vietnam through National Party Congresses, especially from the 9th National Party Congress until now. The 12th National Party Congress affirmed: “...rapid and sustainable development and strive for making ours a modernity-oriented industrial country”(1). To that end, difficulties and challenges of the economy need identification for solutions.

1. Difficulties of Vietnam’s rapid and sustainable development

The shortcomings and weaknesses in the economy are currently hindering the implementation of rapid and sustainable development policy, such as:

- Limited investment capital for development:

In order to achieve the goal of a faster economic growth from now to 2020 and in subsequent years, Vietnam has to increase its investment capital for development. However, this development capital is very limited, particularly:

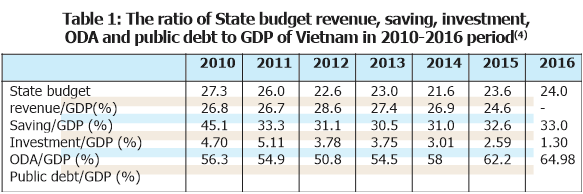

(i) Preferential capitals are being gradually decreased because Vietnam has already joined the group of low average income nations. The Country Director of the Asian Development Bank (ADB) in Vietnam said: “Vietnam has persistently lost its non-refundable aids and preferential ODA loans. This reduces a very significant financial resource which is often used for critical infrastructures”(2). In fact, the ratio of ODA to GDP of Vietnam is experiencing a continuous decrease from 5.11% in 2011 to 1.3% in 2016(3). Especially, 2017 is the last year Vietnam receives preferential ODA loans. After July 1st 2017, Vietnam will only have access to less favorable capital sources.

(ii) Domestic revenue sources (identified as the main source) also show a downward trend. In 2010, the ratio of State budget revenue to GDP reached 27.3% but decreased to 21.6% in 2014; in 2015, it attained 23.6% and had a slight increase in 2016 to 24%. Together with that, Vietnam’s saving to GDP ratio also reduced from 28.6% in 2012 to 24.6% in 2015, and always remained lower than the investment-to-GDP ratio.

(iii) Currently, the national public debt has almost reached the ceiling of 65% of GDP. Bad debt also makes up 10-12% of GDP, making the investment capital for development more limited.

- The quality of human resources is low, the science and technology level is poor.

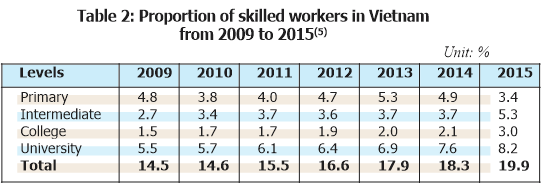

A country aiming at rapid economic growth needs high-level human resources and advanced science and technology. However, these two factors in Vietnam are still limited, considerably hindering the labor productivity and economic growth. Up to now, only 20% of the whole country’s labor force has technical skills (for agriculture, the figure is 4.2%). This shows a lack of a highly professional and skilled labor force.

According to the General Department of Statistics, more than 95% of Vietnamese enterprises are small and micro ones with poor capital, and a poor R&D human resources, both quantitatively and qualitatively, inhibiting their ability to implement technological self-research or innovation. As stated in the Ministry of Science and Technology’s report, about 80%-90% of the machines and technologies used in Vietnamese enterprises are imported from foreign countries, of which 76% are from the 80’s-90’s of the last century; 75% of machinery and other equipment are fully depreciated.

Due to low-level human resources and low-quality science and technology, Vietnam’s labor productivity is very poor and has a slow growth rate, far behind many countries in the region and in the world. By 2015, Vietnam’s labor productivity reached $3,660, just equivalent to 4.4% of Singapore, 17.4% of Malaysia, 35.2% of Thailand, 48.5% of the Philippines, and 48.8% of Indonesia(6).

- The economic growth rate declines, the growth quality remains low

From 1991 to 2005, Vietnam gained continuous economic growth with a relatively high rate of 7.5% per year on average. However, from 2006 till now, the economic growth rate has shown a downward trend. In the period of 2006-2010, it reached 7.0% per year, the figure was 5.91% yearly from 2011 to 2015; in 2016 it was 6.21%, but it reduced to 5.73% in the first half of 2017.

Vietnam growth rate is mainly on a broadening scale, “still depending on factors such as capital, resources, low-level labor, and not much on knowledge, science and technology, and skilled labor. Total factor productivity (TFP) contribution to economic growth is still low”(7). Given the declining growth rate and low quality of growth, it is difficult to achieve rapid and sustainable growth.

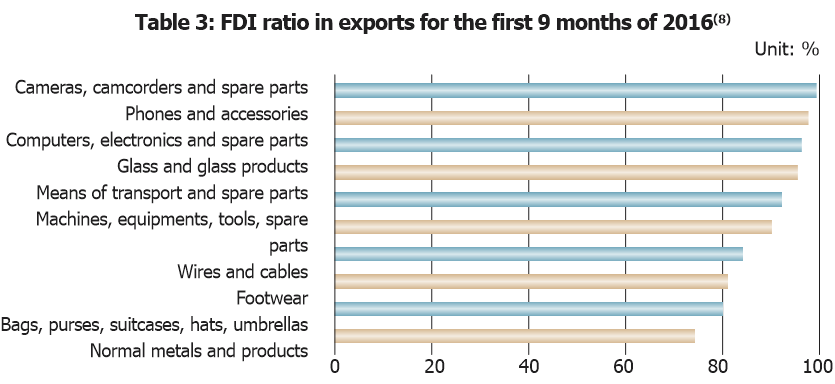

- Outdated export structure, low added value, dependent too much on FDI zone

Vietnam’s export structure is out-of-date with slow transition, which includes mainly traditional goods, raw materials, or crude products with low added values. Many of them are mainly manufactured by simple labor or just in the form of exploited natural resources. Therefore, their value and competitiveness are low. In 2016, in 18 groups of more than USD 2 billion export turn-over, there were 7 groups based on natural resources including crude oil, seafood, rice, wooden product, coffee, nuts, and fruits and vegetables. For the remaining items such as textile, footwear, electronics, computers, phones and spare parts, etc. we just do processing only and not take part in the value chain deeply.

On the other hand, almost all of the inputs are imported, i.e. Vietnam is mainly producing and exporting semi-finished products. Exporting also depends on the FDI sector. In recent years, this sector has always accounted for about 70% of all the country’s export turn-over, threatening the economy’s sustainability.

Economic regime is one of the significant factors enhancing rapid and sustainable economic growth. However, Vietnam’s market economy institution at present does not guarantee the rights of economic entities to freely do business. It also lacks effective arbitration mechanisms, as well as channels for handling economic relationship disputes or creating a solid foundation for a rapid and sustainable economic growth attached to active international integration. The legal system is still not synchronized, which doesn’t meet the requirement of renovating the growth model, restructuring the economy, and implementing three strategic breakthroughs.

An inadequate market economy institution is the main cause of ineffective development resource allocation and high production cost, causing the competitiveness of the economy and the Vietnamese enterprises and products to improve slowly.

2. Challenges to Vietnam’s rapid and sustainable growth

Challenges in implementing rapid and sustainable growth for Vietnam are external (international) obstacles and barriers.

- Deepening integration process into the world economy.

Deepening integration into the world economy brings Vietnam both opportunities for development and risks at the same time. Specifically:

(i) The openness of Vietnam is fairly high (more than 150%), making the economic growth vulnerable due to high dependence on external markets;

(ii) The biggest and most direct challenge is a more intense competition pressure at all three levels: product, enterprise, and nation. Vietnam’s economy and enterprises will have to compete with much stronger competitors in a volatile, unpredictable, and high-risk international environment;

(iii) The increase of capital inflows, especially direct and indirect investment, put pressure on monetary regulation. This raises financial risk in the context of the domestic insufficient insurance mechanism;

(iv) The trend of labor migration among FTA countries causes challenges to local agencies, enterprises, associations, and workers in terms of knowledge, intellect, and skills, etc. The labor force of Vietnam has a low level of professional qualifications and skills (in 2015, the rate of high level professional qualification is only 6.52% of total labor force); the integration capacity of our cadres and civil servants is still restricted, etc;

(v) Deepening international integration makes the influences of negative changes in the financial, monetary, and commodity markets faster and stronger, affecting the stability and sustainable development of the domestic economy;

(vi) Poverty reduction, hunger eradication, and many social policies also face great challenges due to the decreasing public spending.

- The gap of lagging behind other countries in the world

The gap between the scale of Vietnam’s economy and that of other countries in the world has gradually narrowed, but it is still quite big. GDP by current price is 2 times lower than that of Thailand, but equal to Thailand in 2006; 4.5 times lower than Indonesia but equal to it in 2002; 21.3 times lower than Japan but equal to Japan in 1970. In terms of GDP per capita, if the average growth rate in 2011-2015 is maintained at 6.5%, Vietnam needs ten more years to catch up with Indonesia, 16 years to be equal to Thailand and 29 years to reach the same with Japan at present.

- The Industrial Revolution 4.0

+ Economic challenges: the Industrial Revolution 4.0 is likely to strongly influence some key economic sectors of Vietnam; therefore economic growth is also impacted. (i) The energy industry: oil and gas and the power industry is facing long-term deflation due to the trends of effective technology change, energy saving, renewable energy usage to protect the environment, etc. (ii) Textile, footwear, and handicraft industries: these are the three low-cost labor export sectors of Vietnam with the highest increase of export value. However, they are classified as the weakest ones with the lowest added value in Asia. (iii) The manufacturing industry is the sector most affected by the technological changes in the global economy and by the technology transfer mechanism through import and export activities. (iv) Electronic industry: In terms of production capacity, this group is totally influenced by multinational corporations that base facilities in Vietnam to manufacture electronic spare parts and assemble finished-products. Local firms in this industry tend to shrink production or shut down because high-tech products require continuous innovation which is usually a weakness for domestic enterprises in the race for technological creation, quality, and price of products when participating in the world’s supply chain market.

+ Employment: In recent years, repetitive jobs have been gradually automated thanks to technological achievements such as robots or high-speed internet. Globalization makes it easier to shift jobs to lower cost labor and less strict regulations. However, in the Industrial Revolution 4.0, factors that are considered an advantage by developing countries like Vietnam including a simple and low-cost labor force will be no longer a strength, and could be a serious threat.

According to the data in the International Labor Organization’s report, two thirds of 9.2 million textile and footwear employees in Southeast Asia are being threatened by the rapid burst of scientific and technological production application. Specifically, about 86% of Vietnamese, 88% of Cambodian and 64% of Indonesian workers in the textile and footwear sectors will be heavily impacted by the automation and industrialization wave therein(9).

- Global climate change:

According to the General Department of Statistics, in 2016, the damage caused by natural disasters in our country was very intense, equivalent to 2.49% of GDP. This doesn’t include losses due to drought and salt-marshes in the Southern part of the Central Coast, the Central Highlands, the Eastern part of the South, and the Mekong River Delta. As predicted, if the sea level rises by just 1 meter, 40% of the Mekong River Delta, 11% of the Red River Delta and 3% of other coastal provinces’ area will be flooded. Vietnam will lose more than 2 million hectares of rice fields (about 50%). Salinization in coastal areas will reduce the area of agriculture land. About 1.77 million hectares will be salinized, accounting for 45% of land area in the Mekong Delta. High temperature and drought (a lack of irrigation water as well) will affect crop distribution and reduce crop productivity. It is estimated that spring rice yielding productivity in the Red River Delta may decrease by 3.7% per year in 2020 and 16.5% in 2070; seasonal rice yielding productivity will reduce 1% in 2020 and 5% in 2070 if we lack timely and effective solutions. Loss of agricultural land and decline of crop productivity will affect production, goods export, and national food security, hindering economic rapid and sustainable growth.

To overcome these above difficulties and challenges to fulfill rapid and sustainable growth, Vietnam should synchronously implement solutions as follows: stabilize the macro economy, control inflation, improve productivity and competitiveness of the economy, enhance the economic restructuring attached to economic growth model renovation, carry out the three breakthroughs in the socio-economic development strategy 2011-2020, and build an advanced and professional administration.

______________________

(1) CPV: Documents of the 12th National Party Congress, Office of the Party Central Committee, Hanoi, 2016, p. 21.

(2) Vietnam Development Partnership forum 2015 on December 5th 2015 in Hanoi under the theme “Towards a competitive inclusive and sustainable growth”.

(3), (4) Vietnam Economy News, Economy 2016 - 2017, Vietnam and the world, Information and Communication Publisher.

(5) General Department of Statistics: Statistical Yearbook 2016, Statistics Publisher, Hanoi.

(6) http://vneconomy.vn: “23 Vietnamese has the labor productivity equal to 1 Singaporean”.

(7) CPV: Documents of the 12th National Party Congress, Office of the Party Central Committee, Hanoi, 2016.

(8) http://vietnambiz.vn: “Vietnam is an employee of FDI enterprises”.

(9) http://m.tainangviet.vn: “The Industrial Revolution 4.0, opportunities and challenges”.

Assoc. Prof., Dr. Nguyen Thi Thom

Institute of Economics,

Ho Chi Minh National Academy of Politics

Journal Archives

Journal Archives

Media

Photo Gallery

Contact us