Effective investment capital mobilization in Vietnam: Achievements and solutions

(LLCT) - Investment capital plays a vital role in the socio-economic development of each and every nation. Since the 1950s, the UN economists have considered capital shortage an important limitation in the economic growth of developing countries(1). As a developing country which is undergoing industrialization with limited resources, the efficient investment capital mobilization and utilization becomes a decisive factor directly affecting Vietnam’s economic growth in the current period.

Hanoi - Hai Phong Expressway funded by Vietnam Development Bank

with approximated cost of US$2 billion _ Photo: DC

1. Actual situation of capital mobilization in Vietnam

Capital of the State sector

The State’s financial resource for development investment often focuses on key projects which are the driving forces of national economic growth. Its effective utilization will pave the way for other investment capital resources from other economic sectors in the process of socio-economic development, contributing to balance the growth of industries and economic regions.

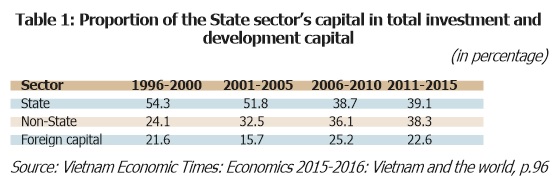

The proportion of the State sector’s capital in the total investment and development capital of the whole society has witnessed a quick decline. In the 1996-2000 period, it accounted for 54.3%. That percentage decreased to 51.8% and 39.1% in the 2001-2005 period and the 2011-2015 period respectively. In 2013, it made up 40.4%. The declining trend is in line with the economic restructuring and the completion of the market economy mechanism. This is also consistent with the CPV’s strategic policies - the State only takes responsibilities in key sectors of the national economy. It will gradually allocate its capital to specific fields and regions where the private sector pays little attention to or beyond their capabilities. Facts show that the State’s investment capital plays an important role in the economic growth, creating a favorable environment to attract capital from other sources, and being a decisive factor in the economic growth. That the proportion of the state capital decreases while maintaining the growth (decreased ICOR) shows its investment effectiveness has been improved.

The size of state capital depends largely on state budget and its income. However, the State income of Vietnam is not stable in the current period. Of the overall income for the state budget, domestic income accounts for a small percentage, mostly from crude oil and import tax. This source of income does not directly reflect the productiveness of business activities and it actually will be affected when crude oil sources are exhausting and the roadmap for tariff reduction is underway.

The non-state capital sources

The proportion of non-state capital sources has increased gradually in the total social investment capital. In the 1996-2000 period, it accounted for 24.1%, in 2001-2005, 32.5%, in 2006-2010, 36.1%, and in 2011-2015, 38.3% respectively(2). This shows that the non-state sector has played a more and more important role in the multi-sector economy of Vietnam, bringing into play the agglomerate strength of all sectors for the overall national development. It is the result of market mechanism that has facilitated all sources of capital, including non-state one. The effectiveness of this capital source is quite high because of the flexibility and cautiousness in using the capital. Though the capital size of non-state enterprises remains small, its flexibility in an open economy has contributed to adapt the national economy to changes of the global economy.

Foreign capital sources

Official development assistance (ODA)

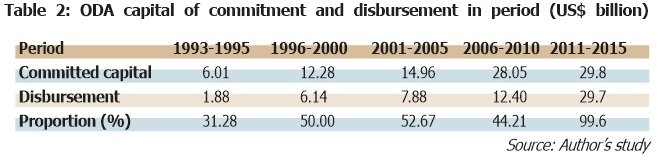

ODA in Vietnam is implemented primarily in three forms, grant (account for 10-12%), preferential loan (80%) and mixed ODA (8-10%)(3). In the past few years, the ODA committed to Vietnam has increased in both quantity and disbursement.

In the 1993-1995 period, the international community committed to give Vietnam about US$6.01 billion, its disbursement ratio was 32%. In the 1996-2000 period, donors committed to provide Vietnam US$12.28 billion, doubling the amount of the previous period.

In the 2001-2005 period, Vietnam asserted its potentialities for economic growth and poverty reduction. As such, when the ODA worldwide decreased, Vietnam continued to receive more, adding up to US$14.96 billion.

In the 2006-2010 period, Vietnam’s integration into the global economy has deepened with its official membership in WTO, the ODA committed capital reached US$28.05 billion with the disbursement ratio of 44.21%.

In the 2011-2015 period, the disbursement rate improved significantly, the total signed capital transferred to the 2016-2020 period is about US$22 billion(4).

This result was all the more significant, given the declining trend of ODA worldwide. Some partners still increased its ODA to Vietnam such as the WB, ADB, Japan and EU. This has asserted Vietnam’s prestige and position with its high economic growth and success in hunger eradication and poverty reduction(5). More than US$80 billion that donors committed to provide Vietnam in the last 20 years have not only brought an important supplementary capital for the process of economic development, hunger eradication, poverty reduction, agricultural development, infrastructure building and human resources training, but also shown the international community’s support to the innovation and development policies of the Party and State of Vietnam as well as donors’ trust in the effectiveness of ODA use in Vietnam(6).

However, the disbursement of ODA projects in the last 25 years has been slow. Especially, the size of this capital source is now decreasing as Vietnam is a country with average income, its economic relationship has changed from development aid to partnership.

Foreign direct investment (FDI)

By the end of 2016, Vietnam has 22,509 valid projects with total registered capital of US$293.25 billion. The accumulated implemented capital of FDI projects was US$154.54 billion (equivalent to 53% of total registered capital). The FDI sector has invested in 19 out of 21 industries, including processing and manufacturing with highest proportion (accounting for 58.8% of total registered capital), real estate (17.7% of total registered capital). 116 countries and territories have invested in Vietnam, of which Korea ranks first with 5,747 valid projects and total registered capital of more than US$50.7 billion (accounting for 17.3% of total investment capital); followed by Japan with 3,280 valid projects and total registered capital of more than US$42 billion (accounting for 14.3% of total investment capital).

FDI projects have their presence in 63 provinces and cities throughout Vietnam, mostly based in key and advantageous localities. In terms of capital size, Ho Chi Minh city attracts the most FDI capital with 6,737 valid projects and registered capital of US$44.82 billion, accounting for 15.3% of total registered capital, followed by Ba Ria - Vung Tau with 342 projects, registered capital of US$26.86 billion, accounting for 9.2% of total registered capital. The third-ranking province is Binh Duong with 3,035 projects, US$26.96 billion registered capital, accounting for 9.1% of total registered capital(7).

The FDI sector has expanded and delopved continuously, becoming an important driving force of the whole economy, helping to create jobs, improve human resources quality, improve technology literacy, increase the exports and facilitate integration, economic structure transfer, actively contributing to the national industrialization and modernization.

Foreign remittance

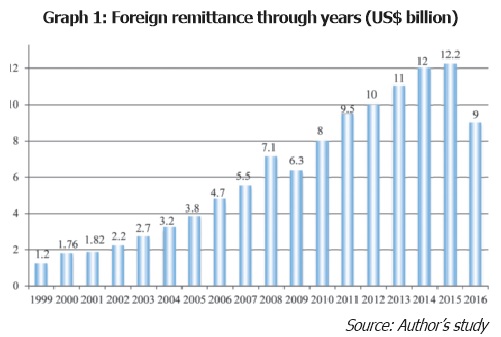

Currently, there are approximately 4.5 million overseas Vietnamese people. This is a huge resource regarding investment capital and creativity capability. Foreign remittance has increased gradually year by year. In the 1996-2000 period, it reached US$4.8 billion, in the next five-year period, it came up to US$13.7 billion. In the periods of 2006-2010 and 2011-2015, it climbed up to US$31.6 billion and US$54.7 billion respectively. This capital source has proved its significance in Vietnam’s development process. It has met the investment demand in Vietnam, helped balance the payment with foreign currencies. Compared with other sources of national income from foreign currencies, foreign remittance has brought more capital than import-export activities (mostly trade deficit). Regarding the remittance - GDP ratio, Vietnam ranks fifth in the world (about 6% of GDP, after Bangladesh, the Philippines, Egypt and Pakistan(8)).

Besides achievements, the process of capital mobilization and utilization still have the following limitations:

Firstly, the disbursement of ODA projects is behind schedule and ineffective. In the long run, this capital, if not strictly controlled, will leave behind a huge national debt. Vietnam’s legal framework contains many differences compared with international practices and donors’ expectations.

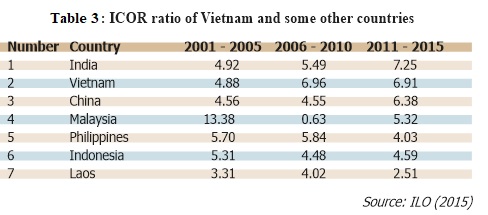

Secondly, economic growth depends much on investment capital but effectiveness of using this capital from all sources remains low. This is clearly shown in some works and projects which do not function properly; the ICOR ratio is still high and increasing.

ICOR shows that in the 2001-2005 period, in order to produce 1 Vietnam Dong of GDP, Vietnam had to invest 4.88 Vietnam Dong for the cumulative asset value. In the following periods, this ratio remained high, 6.96 and 6.91 in the 2006-2010, and 2011-2015 periods. The economy experienced slower growth but needed more capital.

Thirdly, the restructuring of public investment has recorded initial successes but the investment still remains scattered and ineffective, especially with investment from state budget. The number of projects in a waiting list for state investment are increasing, despite the fact that they are not matching with annual capital balance of the State. That investors from ministries and localities fail to follow strict regulations on investment and construction leads to losses in capital construction.

Fourthly, capital mobilization in the last few years has faced many difficulties. It is the result of an underdeveloped domestic market, people’s low income and demand, slow equitization of state companies, unattractive policies on resources mobilization for all sectors, unappealing investment environment and unfriendly State administration mechanism.

Fifthly, FDI quality is still limited, failing to draw projects with high technology content and widespread influence which continue to attract modern industries. The ratio of FDI implementation capital versus its registered capital accounts for just 46% by the end of 2016.

Sixthly, non-state capital potentials remain untapped, thus failing to mobilize them to business production. The capital flow into various fields and sectors continues to be short-termed and unsustainable due to psychological factors, not market rules. The number of non-State enterprises going bankrupt or suspending production have increased over the past few years: In 2010, 4,000 enterprises, in 2011, 53,000, in 2012, 54,000, in 2013, 60,800, in 2014, 67,800 and in 2015, 71,400(9).

2. Solutions for effective mobilization of investment capital

The 12th National Congress of the CPV put forward the 5-year plan for the 2016-2020 period: “The average 5-year economic growth of 6.5-7%/year. The total social investment capital accounts for 32-34% of GDP”(10). The Government has made great efforts to mobilize all capital sources, but it is still unable to meet the huge investment demand of the whole economy. Accordingly, some groups of solutions should be done so that the target of economic growth is to be achieved:

Firstly, an investment environment and legal framework closely attached to international practices should be set up to improve investment efficiency. This is the key solution to mobilize capital sources because the more effective the investment, the more likely capital is mobilized.

Secondly, the potential of investment capital should be assessed among economic sectors, to which the private sector should be paid due attention, making suitable policies to encourage investors and mobilize capital sources. At the same time, the State should also have orientation policies to create close links between capital sources for mutual development.

Thirdly, external capital sources should be attracted. Especially, for ODA, the focal task in the 2016-2020 period is to complete programs and projects by the committed schedule, bringing works into operation, meeting the demand for socio-economic development of Vietnam. The quality of FDI projects should also be improved, meeting both the investment capital demand and the modernization of domestic production. Overseas Vietnamese should be encouraged to invest in their home country with incentive policies.

Fourthly, the capital market, with the stock market as its core, should be developed to mobilize capital from the people, enterprises, financial organizations, or government. Compared with the capital mobilization via banks, the stock market is more effective, flexible and diversified, quickly satisfying the capital demand of society.

Fifthly, the relevant functions of the Ministry of Planning and Investment should be fostered, especially in clearing the investment capital flow. The Ministry should prioritize the research on and completion of macro policies in mobilizing resources from all economic sectors, improving the effectiveness of investment promotion activities.

Given the determination of the Vietnamese Government and its better investment environment, the target of socio-economic development set for the 2016-2020 period by the 12th National Party Congress is likely to be fulfilled.

______________________

(1) E.Wayne Nafziger: The economics of developing countries, Statistics Publishing House, Hanoi, 1998, p.453.

(2) The author’s synthesis from Annual Statistics.

(3) http://vietnamnet.vn.

(4) http://vneconomy.vn.

(5) Vietnam Economic Times: Economics 2003-2004: Vietnam and the World, p.46.

(6) http://baocongthuong.com.vn.

(7) Nguyen Tan Vinh: A review of FDI value in Vietnam after 30 years, Economics and Heralds Magazine, 1-2017, p.31.

(8), (9) Vietnam Economic Times: Economics 2015-2016, Vietnam and the World, p.96, 70, 19.

(10) CPV: Documents of the 12th National Congress, Office of the Central Party Committee, Hanoi, 2016, p.272.

Dr. Nguyen Tan Vinh

Academy of Politics, Region II

Journal Archives

Journal Archives

Media

Photo Gallery

Contact us